Frequently Asked Questions

Claims Procedure

Q1. Where can I obtain the claim forms?

The claim forms can be obtained directly from any Hong Leong Assurance (HLA) branch or alternatively from the servicing agent who has access to download and print the claim forms via Agency Portal.

Q2. Where can I obtain the claim forms?

Step 1: Forms obtained via: HLA Head Office / Branch or Agent

Step 2: Complete the required forms and ensure all relevant claim documents are gathered

Step 3: Submit the relevant documents and completed form(s) to HLA Head Office or nearest branch

Step 4: Successfully Claim Submission

Q3. Where can i obtain the claim requirement letters?

Once a claim notification has been submitted to us, we will assess it and determine if there are further documents needed. We will then notify you in writing and send the claim requirement letter.

Q4. Who can certify the claim documents?

Certification of documents as “Original Sighted” can be done by Solicitors, HLA Head Office and Branch Executive / Manager, Agency Manager / Unit Manager or Commissioner for Oaths.

Note: Certification of documents other than Birth Certificate, Identity card (for non-foreigner) and Passport (for foreigner) as “Original Sighted” by Unit Manager must be countersigned by the Agency Manager.

Q5. Can a claim for medical reimbursement be made with photocopied, duplicated copy, reprinted copy, certified true copy of bill, receipt and/or tax invoice?

- Receipts/bill lost

- Make a Statutory Declaration of the Loss of Original Receipt/Bill before commissioner for Oaths

- Obtain a certified true copy of the receipt/Bill from the issuing party

- Submit to HLA

Q6. Where can I obtain the form to declare loss of original receipts, bills and tax invoices?

Q7. If the employer or other insurance company does not cover the medical expenses in full, can the Policy Owner claim for the balance under the Hospital and Surgical plan in HLA?

Q8. How do I submit an Outpatient Cancer Treatment claim?

Q9. SectionIf my employer or other insurance company does not cover the Outpatient Cancer Treatment in full, can I claim the balance under the Hospital and Surgical plan in HLA?

Q10. How do I submit an Outpatient Kidney Dialysis claim?

Q11. If my employer or other insurance company does not cover the Outpatient Kidney Dialysis in full, can I claim the balance under the Hospital and Surgical plan in HLA?

Q12. How to enquire if I wish to check the claim status or further clarify any doubts in claim decision?

You may check the status of your claim via the following options:

- Contact Customer Service Hotline at 03-7650 1288.

- Contact the claim submission branch or any HLA branch nationwide.

Claim submission branch refers to the branch where the claim documents were submitted. - Send an email to customerservice@hla.hongleong.com.my.

Q13. If I am dissatisfied with claim decision, can I submit an appeal?

Q14. How to submit the request for reimbursement of medical report fee?

Customer who had assisted HLA in obtaining medical report may request for reimbursement of the medical report fee by submitting the necessary documents as listed below:

- Duly completed Direct Credit / E-Payment Form if not submitted during the claim submission.

- A photocopy of Bank Statement or Bank Passbook if not submitted during the claim submission.

- Original sighted copy of Identity card (for non-foreigner) or passport (for foreigner), if not submitted earlier.

- The original receipt and tax invoice being proof of payment for the medical report.

Q15. Who is the rightful payee of the claim?

The claim cheque will be issued to the rightful payee based on the following categories and priority:

Living claim i.e. Hospitalisation & Surgical claim,Total & Permanent Disability claim, Weekly Indemnity claim, Dread Disease claim, Hospitalisation Benefit claim

- Absolute assignee.

- Policyholder.

- Executor or administrator of the estate of the policyholder, if the policyholder dies before he encashes the cheque.

Death claim – Policyholder’s death

- Assignee.

- With nomination.

- Competent nominee for both trust and non-trust nominee.

- If the nominee is a trust nominee who is incompetent to contract, pay to the appointed trustee; if there is no appointed trustee, pay to the parent of the incompetent nominee as presumed trustee.

- If the nominee is a non-trust nominee who is incompetent to contract, pay to Public Trustee or a trust company nominated by the policyholder or obtain a Letter of Administration or Grant of Probate.

- Without nomination.

- Pay to policyholder’s spouse, child and parent in accordance with Distribution Act provided that the policyholder never leaves a Will.

- If policyholder leaves a Will, pay in accordance with Grant of Probate.

- If no Will, no spouse, no child and no parent, pay in accordance with Letter of Administration.

Death claim – Non-policyholder’s death

- Absolute assignee.

- Policyholder.

- Executor or administrator of the estate of the policyholder, if the policyholder dies before he encashes the cheque.

Q16. Who is the rightful payee for Mortgage Decreasing Term Assurance (MDTA) / Credit Life / Hire Purchase?

Q17. What is the MDTA sum assured to be paid?

Q18. What should I do if the claim cheque is lost in transit or staled?

For claim cheque that is lost in transit or has stale, you may change the method of payment to Direct Credit / E-Payment. Please provide us with the documents listed below which can be obtained from any HLA Head Office / Branches:

Cheque lost in transit

- Stop Cheque Request Form.

- Duly completed Direct Credit / E-Payment Form.

- A photocopy of Bank Statement or Bank Passbook.

- Original sighted copy of Identity card (for non-foreigner) or passport (for foreigner).

Stale cheque

- Duly completed Direct Credit / E-Payment Form.

- A photocopy of Bank Statement or Bank Passbook.

- Original sighted copy of Identity card (for non-foreigner) or passport (for foreigner).

Q19. How long will the claim payment be ready after all claim investigations had been completed?

For Major claims without involving unit redemption, the claim payment shall be ready after 7 Working Days from the date the last document is gathered and investigation had completed. Meanwhile, for unit linked policies involving daily pricing redemption and weekly pricing redemption, additional time is required for the process of selling the units, thus the claim payment shall be ready after 9 and 16 Working Days respectively from the date the last document is gathered and investigation had completed. Major claims include Death claim, Dread Disease claim, Old Age Disablement claim, Total & Permanent Disability claim, Congenital Anomalies claim, Facial Reconstructive Surgery claim and Pregnancy Care or Pregnancy Complication claim.

As for Minor claims, the claim payment is ready after 6 Working Days from the date the last document is gathered and investigation had completed. Minor claims include Hospitalisation Benefit claim, Hospital Benefit on Childbirth claim, Hospital & Surgical claim, Personal Accident and Dismemberment claim.

Q20. What is Direct Credit / E-Payment?

Direct Credit / E-Payment is defined as payment via direct deposit into the rightful payee’s bank account.

Q21. What documents are required for Direct Credit / E-Payment?

The following documents are required:

- Duly completed Direct Credit / E-Payment Form.

- A photocopy of Bank Statement or Bank Passbook.

- Original sighted copy of Identity card (for non-foreigner) or passport (for foreigner).

Note: Hong Leong Assurance reserves the right to request for other documents if needed to transact the Direct Credit / E-Payment.

Q22. Why should I choose to receive funds via Direct Credit / E-Payment?

- Secure – Chance of misplaced, stale, lost or expired will no longer be an issue.

- Convenient – Fast and convenient as it removes the need to travel and deposit the cheques at the bank as payment are credited directly in the payee’s account.

- Reduce Cost – Improve sale productivity level and lower the cost of doing business as the resources involved in follow-up and travelling will be reduced.

- Faster – Funds will be available by the next working day after the payment instruction is sent to bank. Government is currently working with all banks for the same day settlement.

Q23. Section Will there be any registration fees imposed if I wish to use Direct Credit / E-Payment?

No, you can enjoy the service free of any charges.

Q24. Can I change my bank account information?

Yes, you have to submit a fresh Direct Credit / E-Payment Form.

Q25. What will happen to claim payment which cannot be credited into the claimant’s account?

Q26. How will the claim payment be made if the payee has been blacklisted by the Bank / adjudicated a bankrupt and unable to open a bank account?

The payee has to provide an official letter from Malaysia’s Department of Insolvency to allow payment to the rightful debtor or payee.

Emergency Evacuation & Repatriation Process

Ombudsman For Financial Services

Q1. FAQ What is Ombudsman For Financial Services (OFS)?

The OFS is a dispute resolution body for eligible complainants. It is an alternative to, and not a replacement for court proceeding.

Q2. Who are the members of OFS?

- Bank and Islamic banks;

- Insurance companies and takaful operators;

- Development financial institutions;

- Designated payment instrument issuers and designated Islamic payment instrument issuers;

- Insurance/takaful brokers; and

- Financial advisers and Islamic financial advisers.

Q3. What is the jurisdiction of OFS?

OFS will consider disputes against the members that fall within the following limits:

- RM250,000 for a dispute involving financial services or products other than a dispute in (ii) and (iii) below;

- RM10,000 for a dispute on motor third party property damage insurance/takaful claims; and

- RM25,000 for a dispute on an unauthorized transaction through the use of a designated payment instrument or a payment channel such as internet banking, mobile banking, telephone banking or an unauthorized use of cheque.

Q4. Who can lodge a dispute?

Q5. How to lodge a dispute with OFS?

Step 1 – Refer your dispute to your Financial Service Provider.

Before you lodge any dispute with OFS, you must first refer your dispute to the member concerned with a view to finding an amicable settlement.

Step 2 – Lodge a dispute with OFS

You can file your dispute with OFS through:

| Email to | : | enquiry@ofs.org.my |

| Fax to | : | 603 2272 1577 |

| Write to | : | Chief Executive Officer Ombudsman for Financial Services (Formerly known as Financial Mediation Bureau) Level 14, Main Block, Menara Takaful Malaysia No. 4, Jalan Sultan Sulaiman, 50000 Kuala Lumpur |

Alternatively, you can file the dispute in person at OFS office. Operating hours are: Monday to Friday, from 8.30am to 5.30pm.

Please log on to OFS website at www.ofs.org.my to access online complaint form

Q6. Do I need to pay for OFS services?

Q7. Is there a time frame for lodging a dispute with OFS?

Yes. You must lodge your dispute with OFS:

- within 6 months from the date of the final decision by the member concerned; or

- after 60 calendar days from the date of your dispute was first referred to the member in respect of which no response has been received from that member.

Q8. What are the documents required?

Q9. How long does OFS take to resolve my dispute?

Q10. . Do I need to engage the service of a lawyer?

Q11. Will the document submitted by me to OFS be disclosed to third party other than the member?

Importance of Making a Nomination

Q1. FAQ Importance of Making a Nomination

We wish to bring to your attention that it is important for you to make a nomination for your Life Policy in order to safeguard the interest of your loved ones.

You may print the Nomination Form from this website or you may contact our Customer Service Hotline at 03-76501288 in order to obtain the same. Should you require any assistance, please do not hesitate to contact our nearest branch or our Customer Service Hotline at 03-76501288

Medical Card Services

Q1. FAQ How to enquire the Guarantee Letter status and decision?

Contact our Third Party Administrator (TPA) by calling the phone number on your medical card. They operate 24 hours a day, 7 days a week.

Q2. Why is deposit required for some panel hospitals?

Some hospitals require deposit upon admission; however, this is refundable by the hospital upon deducting the deductible, co-insurance amount and non-covered charges.

Q3. What are the reasons causing Life Assured having to wait for a long time prior to be admitted?

The delay is normally caused by the doctor as he needs to perform several diagnostic examinations to determine the condition of the Life Assured before deciding if admission is required. The doctor is also required to complete a medical report with details of Life Assured’s condition before the hospital staff could fax it over to Third Party Administrator for issuance of initial Guarantee Letter.

Q4. Can Life Assured admit to non-panel hospital?

Q5. Can Life Assured stay in a room that charges higher than his/her room and board limit?

Yes, however Life Assured will need to pay the difference (excess room and board) if he/she choose to stay in a room that charges higher than the room and board limit.

Q6. Can Life Assured utilise the Guarantee Letter without presenting the medical card to hospital?

Q7. What are the circumstances whereby Guarantee Letter will be declined and Life Assured will need to settle own hospital bill?

The common reasons/scenarios when Life Assured will need to settle own hospital bill are when:

- Condition falls under policy exclusion/ personal exclusion.

- Suspect of pre-existing conditions which were not declared during insurance application.

- Policy has lapsed or terminated.

- Admission is for investigation purposes only.

- It is for outpatient visit, pre-admission or post-hospitalisation visit.

Q8. What is the next course of action for Pay & File claim after the Guarantee Letter is declined?

Q9. What are the common non-payable items?

- Admission fees

- Telephone charges

- Excess room and board

- Excess policy limit

- Co-Insurance / deductibles

Q10. Why Life Assured has to wait for a minimum of 4-5 hours for discharge?

Q11. Can Life Assured pay the admission bill before final Guarantee Letter is issued?

Q12. Can Life Assured enjoy the Guarantee Letter overseas?

Q13. What is Emergency Evacuation & Repatriation service?

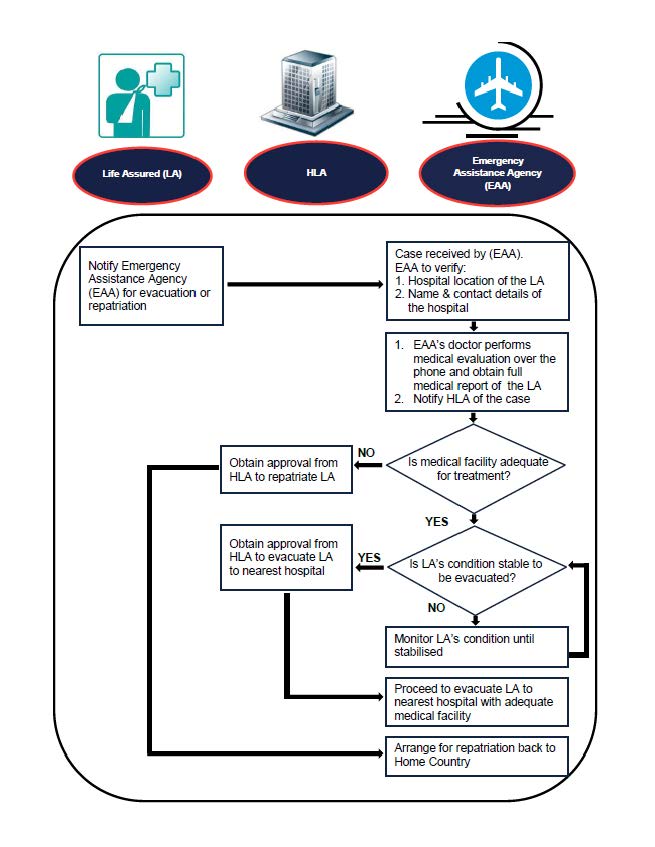

Emergency Evacuation

Emergency evacuation is a service provided via emergency assistance agency who will arrange for the air and/or surface transportation and communication for moving Life Assured when in a serious medical condition to the nearest Hospital where appropriate medical care is available and not necessarily to Malaysia. The emergency assistance agency shall pay for the medically necessary expense of such transportation and communications and all usual ancillary charges incurred in such services so arranged by the emergency assistance agency.

The emergency assistance agency retains absolute right to decide whether the Life Assured’s medical condition is sufficiently serious to warrant emergency medical evacuation. The emergency assistance agency further reserves the right to decide the place to which the Life Assured shall be evacuated and the means or method by which such evacuation will be carried out having regard to all the assessed facts and circumstances of which the emergency assistance agency is aware at the relevant time.

Emergency Repatriation

Emergency repatriation is a service provided via emergency assistance agency who will arrange for the return of Life Assured to Malaysia following an emergency medical evacuation for subsequent hospitalisation outside Malaysia. The emergency assistance agency shall pay for the expenses necessarily and unavoidably incurred in the services arranged by the emergency assistance agency.

The emergency assistance agency reserves the right to decide the means or method by which such repatriation will be carried out having regard to all the assessed facts and circumstances of which the emergency assistance agency is aware at the relevant time.

Q14. How to file Emergency Evacuation & Repatriation claim?

Premium payment

Q1.Auto Debit

Pay your premium from your savings or current bank account via the Auto-Debit facility. Please obtain the following forms at any of our branches nationwide.

- Maybank Auto Debit Form (applicable to Maybank account only) or

- MyClear Direct Debit Authorization Form (for participating banks listed below)

| No. | Bank |

| 1 | Bank Islam Malaysia Berhad |

| 2 | Bank Kerjasama Rakyat Malaysia Berhad |

| 3 | CIMB Bank Berhad |

| 4 | Citibank Berhad |

| 5 | Deutsche Bank Malaysia Berhad |

| 6 | Hong Leong Bank Berhad |

| 7 | HSBC Bank Malaysia Berhad |

| 8 | Malayan Banking Berhad |

| 9 | OCBC Bank Malaysia Berhad |

| 10 | Public Bank Berhad |

| 11 | RHB Bank Berhad |

| 12 | Standard Chartered Bank Malaysia Berhad |

| 13 | Bank Of America Merrill Lynch |

| 14 | J.P.Morgan Chase Bank Berhad |

Q2. Standing Instruction

Pay your premium via VISA/ MasterCard. Submit your Credit Card Standing Instruction request online at My Transactions i.e. Update Payment Method.

Q3. E-Payment

Pay your premium via internet banking! If you have an account in any one of these banks, you can log on and pay online!

- Hong Leong Bank Berhad – www.hlb.com.my

- CIMB Bank Berhad – www.cimbclicks.com.my

- Malayan Banking Berhad – www.maybank2u.com.my

- Public Bank Berhad – www2.pbebank.com.my

- JomPAY

Banks offering JomPAY – Click

Q4. Direct Banking

| Bank | Bank Account Number | Over the counter | Deposit Machine |

| HLB | 00100108802 | Cash and Cheque | Cheque Only |

| BSN | 1410029830311241 | Cash and Cheque | N/A |

Disclaimers:

If you use the following premium payment methods, please note that HLA will require a minimum of 2 workings days to update your policy provided you have given a valid policy number.

- Internet Banking

- Over the counters of banks

- Cheque deposit machines

Q5. Direct Payment

If you prefer to make your payment personally, visit our Customer Service Centre at our Head Office or our nearest branch located across the country.

Operational hours:

| Monday to Friday | 9.00am to 6.00 pm |

| Saturday, Sunday and Public holiday | Closed |

Important Notice:

Please take note that all types of premium payment must be remitted to HONG LEONG ASSURANCE BERHAD.

Payment via cheque or bank draft must be crossed and made payable to HONG LEONG ASSURANCE BERHAD with the details of Policy No. and Name of Life Assured stated on the reverse side of this document.

Documentation of the Respective Claims Types

Important Note

1. *Certification of documents as “Original Sighted” should only be done by either Solicitor, Commissioner for Oaths, HLA Head Office and Branch Executive / Manager, Agency Manager or Unit Manager.Certification by Unit Manager needs to be countersigned by Agency Manager.

2. **Certification of documents as “Original Sighted” should only be done by either Solicitor, Commissioner for Oaths, HLA Head Office and Branch Executive / Manager, Agency Manager or Unit Manager.

Q1. Death Claim

- Claim Forms:

- Death Claim Application Form duly completed by the person entitled to the policy moneys.

- Medical Attendant’s Report for Death Claim duly completed by a registered medical practitioner at the claimant’s own expense.

- Supporting Documents:

- Original sighted copy of Death Certificate*.

- Original Policy Contract / Deed of Assignment / Assurance Certificate.

- Other supporting documents to prove the eligibility of cover for Non-Employee Benefits type of Group Term Life Policy and Other Financial Institution Group Policy.

- Original sighted copy of last two (2) months’ Payslips* and Appointment Letter* (Applicable only for Employee Benefits policy).

- Original sighted copy of Post Mortem report* (if any).

- Original sighted copy of Police Report* if the cause of death was due to accident and if a report has been lodged to the police.

- Newspaper cuttings (if the incident is reported in the newspaper).

- Original sighted copy of deceased’s Birth Certificate** / Identity card (for non-foreigner)** / Passport (for foreigner)** / Patient Card.

- Proof of Relationship of the Claimant / Next-of-Kin / Policy Owner to the Deceased i.e. Original sighted copy of Birth Certificate** or Marriage Certificate*.

- Original sighted copy of the claimant’s Identity card (for non-foreigner)** or Passport (for foreigner)** is required for claim payment via Direct Credit / E-Payment.

- A photocopy of Bank Statement or Bank Passbook for Direct Credit / E-Payment.

- Direct Credit / E-payment Form duly completed by the person entitled to the policy moneys.

Q2. Living Claim inclusive of Dread Disease Claim, Old Age Disablement Claim, Total & Permanent Disability Claim, Congenital Anomalies Claim, Facial Reconstructive Surgery Claim and Pregnancy Care or Pregnancy Complication Claim

- Claim Forms:

- Living Claim Application Form duly completed by the person entitled to the policy moneys.

- Medical Attendant’s Report duly completed by a registered qualified physician at the claimant’s own expense.

- Supporting Documents:

- Original Policy Contract / Deed of Assignment / Assurance Certificate.

- Other supporting documents to prove the eligibility of cover for Non-Employee Benefits type of Group Term Life Policy and Other Financial Institution Group Policy.

- Original sighted copy of last two (2) months’ Payslips* and Appointment Letter* (Applicable only for Employee Benefits policy).

- Original sighted copy of Police Report* if the cause of disability was due to accident and if a report has been lodged to the police.

- Original sighted copy of laboratory / test report* if diagnostic or investigation has been carried out.

- Original sighted copy of the Life Assured’s (event person) Identity card (for non-foreigner)** or Birth Certificate** or Passport (for foreigner)**.

- A photocopy of itemised in-patient bills and receipt (applicable only for Facial Reconstructive Surgery Claim).

- Original sighted copy of the Policy Owner’s Identity card (for non-foreigner)** or Passport (for foreigner)** is required for claim payment via Direct Credit / E-Payment.

- A photocopy of Bank Statement or Bank Passbook for Direct Credit / E-Payment.

- Direct Credit / E-payment Form duly completed by the person entitled to the policy moneys.

Q3. Hospitalisation Benefit / Hospital Income Benefit / Hospital & Surgical Claim

- Claim Forms:

- Hospitalisation Benefit / Hospital Income / Hospital & Surgical / Personal Accident / Dismemberment Claim / Loss of Travelling Documents Application Form duly completed by the person entitled to the policy moneys.

- Medical Attendant’s Report on Hospitalisation Benefit / Hospital Income / Hospital & Surgical / Personal Accident / Dismemberment Claim duly completed by a registered medical practitioner at the Claimant’s own expenses.

- Supporting Documents:

- Original itemised hospital bill for Hospital & Surgical claim.

- A photocopy of itemised hospital bill is required for Hospitalisation Benefit / Hospital Income Benefit claim.

- Original official receipts and tax invoices for Hospital & Surgical claim.

- Confirmation letter on incurred expenses being reimbursed by other party i.e. SOCSO, other Insurer, Employer (if applicable).

- Original sighted copy of Police Report* if the cause of disability was due to accident and if a report has been lodged to the police.

- A photocopy of event person’s Birth Certificate / Identity card (for non-foreigner) / Passport (for foreigner) / Patient Card.

- Original sighted copy of the Policy Owner’s Identity card (for non-foreigner)** or Passport (for foreigner)** is required for claim payment via Direct Credit / E-Payment.

- A photocopy of Bank Statement or Bank Passbook for Direct Credit / E-Payment.

- Direct Credit / E-payment Form duly completed by the person entitled to the policy moneys.

Q4. Hospital Benefit on Childbirth Claim

- Claim Forms

- Hospitalisation Benefit on Childbirth Claim Application Form duly completed by the person entitled to the policy moneys.

- Supporting Documents:

- Original sighted copy of child’s Birth Certificate**.

- Original sighted copy of itemised hospital bill*.

- Original sighted copy of the Policy Owner’s Identity card (for non-foreigner)** or Passport (for foreigner)** is required for claim payment via Direct Credit / E-Payment.

- A photocopy of Bank Statement or Bank Passbook for Direct Credit / E-Payment.

- Direct Credit / E-payment Form duly completed by the person entitled to the policy moneys.

Q5. Personal Accident / Dismemberment Claim

- Claim Forms:

- Hospitalisation Benefit / Hospital Income / Hospital & Surgical / Personal Accident / Dismemberment Claim Application Form duly completed by the person entitled to the policy moneys.

- Medical Attendant’s Report on Hospitalisation Benefit / Hospital Income / Hospital & Surgical / Personal Accident / Dismemberment Claim duly completed by a registered medical practitioner at the Claimant’s own expenses.

- Supporting Documents:

- Original copies of itemised hospital bill(s) and receipt(s).

- A photocopy of X-ray report (if any).

- A photocopy of medical leave / light duty certificate(s).

- Newspaper cutting (if the incident is reported in the newspaper).

- Original sighted copy of Police Report* if the cause of disability was due to accident and if a report has been lodged to the police.

- A photocopy of event person’s Birth Certificate, Identity card (for non-foreigner), Passport (for foreigner).

- Original sighted copy of the Policy Owner’s Identity card (for non-foreigner)** or Passport (for foreigner)** is required for claim payment via Direct Credit / E-Payment.

- A photocopy of Bank Statement or Bank Passbook for Direct Credit / E-Payment.

- Direct Credit / E-payment Form duly completed by the person entitled to the policy moneys.

E- Payment for Policy Administration/ Policy Benefits

Q1.E- Payment for Policy Administration/ Policy Benefits

Contact our Third Party Administrator (TPA) by calling the phone number on your medical card. They operate 24 hours a day, 7 days a week.

Q2. Why choose e-Payment?

Fast, convenient and secure.

Q3. What do I have to do to receive funds via e-Payment?

It’s simple; submit your bank account details online at My Transactions i.e. Update Direct Credit/ E-Payment.

Q4. Will there be charges imposed if I want to use e-Payment facility?

Q5. Is there any restriction on the type of bank account that can be used for e-Payment?

Direct Credit / E-Payment is only available for direct credit to banks participating in the Interbank GIRO payment system (IBG) which are subject to changes.

You can assign any of your existing active saving or current account held under your name or a joint account that has your name as the first accountholders.

For e-Payment with joint account, please ensure that your name and NRIC/Passport number must be the First Account Holder’s details as it will be the first criteria for bank verification purposes.

Q6. When will my bank account be credited?

Payment will be made electronically into your bank account as soon as your request has been approved and fully authorized by the authorized signatories. Funds will be made available in your bank account within the same business day of payment if it is transmitted to the bank. However, depending on the operations time and processes adopted by your bank, you may receive the payment on the same business day or a day after.

Note: Payment is made at the direction of, and based on information provided by, the originator of the payment instruction. If incorrect information is given or the originator revokes the payment instruction or any other circumstances arises which is beyond our control, this may result in payment being delayed or not received. The actual date of credit funds is also dependent on the clearing system(s) used and the beneficiary’s bank.

Q7. Will I be notified once the Hong Leong Assurance has made the payment?

Q8. What will happen to funds that cannot be credited into my bank account?

Q9. Is it compulsory to give my bank account details and the required documents to get paid by e-Payment? What If I do not wish to reveal my banking details – how do I get paid?

E-Payment is the most efficient, convenient and safest method of payment. However, in the event you do not wish to receive payments directly to your bank account, we will remit the payment to you via cheque. The turnaround time will be extensive as compared to e-Payment.

Q10. Can I change my bank account information?

Q11. Do I need to provide my bank account information separately for e-Payment for each of my policy if I have more than one policy?

You are not required to provide your bank account information separately if you have more than one policy with same Policy Owner and Life Assured. However if you have policies with different Policy Owner and/or different Life Assured, hence separate form needs to be submitted.

We will update your bank details as and when you submit your Direct Credit / E-Payment Form together with Policy Benefits withdrawal request. Your latest bank details will be updated into our system.

Q12. How will my bank account information be used and will it remain confidential?

Introduction to E-Payment

Q1. What is E-Payment?

i. Electronic payments are payments that are made directly to payee from the bank accounts using security features over the Internet.

ii. Simple, safe and convenient way for you to pay bills or make regular and recurring payments directly from bank accounts.

iii. You can make payments at anytime, anywhere.

Q2. How E-Payment will benefit you?

i. SECURE – It is more secure than paying by cheque or cash

ii. SAVE YOUR TIME – Fast and convenience

iii. REDUCE COST – Help you to better manage your money

iv. FLEXIBILITY – Payment plans can be set up automatically according to collection frequency

Q3. How to start with E-Payment?

Please contact our friendly Agent or our Customer Service Officer at 03-7650 1288 for further details.

Q4. E-Payment to HLA via Online Payment

Pay your premium via internet banking! If you have an account in any one of these banks, you can log on to the website and pay online!

CIMB Bank Berhad – www.cimbclicks.com.my

Hong Leong Bank Berhad – www.hlb.com.my

Malayan Banking Berhad – www.maybank2u.com.my

Public Bank Berhad – www2.pbebank.com.my

MG I, MG II & MG III Premium/ Insurance Charge Revision

Q1. FAQ Importance of Making a NominationI have not made any claims, why is my premium/insurance charge going up?

The main reason for the increase is due to the medical inflation. The cost of medical care and services continues to increase at a pace faster than the general inflation. This increase has affected the claim experience of our medical insurance products.

Insurance is based on the concept of risk pooling, where provisions for claims are pooled together for all policies. The claims are paid out from the pool. As the amount of claims increases, it is necessary for us to increase the premium/insurance charge to ensure that you receive at least the same level of benefits as you expected when you first took out the policy.

Q2. Is my past claim the reason why my premium/insurance charge has increased?

Insurance is based on concept of risk pooling. All claims are pooled and shared by all policyholders within the same portfolio. The individual policyholder is not penalized with a higher premium/ insurance charge for having made a medical claim.

Q3. How frequent will my premium be adjusted?

The overall cost of healthcare in Malaysia increases every year. In order to keep pace with this increase while continuing to provide you with adequate cover, we carefully review the claim experience of each product annually to determine if the current premium/insurance charge remains sustainable. Premium/ insurance charge adjustments are only conducted when the actual claim experience has exceeded what we have projected.

Q4. When was the last time when the premiums of MedGLOBAL / MedGLOBAL II/ MedGlobal III plans were revised?

| MedGLOBAL and MedGLOBAL III (Conventional) | 2010 |

| MedGLOBAL and MedGLOBAL III (investment-linked) | 2011 |

| MedGLOBAL II | Never |

Q5. Is the re-pricing solely determined by HLA or is this a common practice in the industry?

We have a rigorous process to ensure that premium/insurance charge adjustment is done justly. Premium/ Insurance charge of medical plans are not guaranteed and thus individual companies issuing such policies will make their own reviews based on the prevailing medical costs and past claim experience. Insurance companies are known to make premium/ insurance charge reviews regularly and the adjustments are based on the individual company’s claim experience.

Q6. When do I start paying the higher premium/insurance charge?

The change will take effect on your next policy/rider anniversary. A notice of at least 90 days will be given to policyholders before the increase is in effect.

Q7. Does the increase come with additional benefit?

Q8. Do I have to complete a new Credit Card Standing Instruction (CCSI) for the premium adjustment?

Q9. . I’m currently paying my premiums through Direct Debit. Do I have to complete a new Direct Debit Form for the premium adjustment?

There are two ways to change your existing standing instruction.

- If you have previously arranged the facility directly with your bank, you will have to inform the bank to pay the new premiums.

- If you have arranged the facility through HLA, you can submit the Direct Debit Authorisation Form (original copy) to us to increase the limit and we will handle the rest for you.

Q10. Will my Investment-linked fund value be able to support my revised insurance charge if I do not make any top up?

Your Investment-linked policy provides insurance protection through the deduction of insurance charges of the basic sum assured and any riders attached, as well as the policy fee from the available invested funds under the policy. As the value of these units of invested funds change with the market conditions and insurance charges do increase with age or may be revised, it is prudent to have a sufficient fund value that can support such monthly deductions at all times.

You are advised to review if your regular premiums or the fund value are sufficient to sustain your policy. HLA will send out pre-lapse notices when the fund value of the policy is expected to be insufficient to pay for the insurance charges.

Q11. I do not want to pay the higher new premium/insurance charge but I still need the cover. What options do I have?

Q12. I’m not sure if my medical plan meets my needs anymore. Can I change to other plan?

Your medical insurance needs will change over time as you progress in life and have different financial obligations. It is crucial to periodically review your medical insurance based on your current lifestyle and budget needs.

We currently offer MedGLOBAL II, HLA MedGLOBAL IV Plus, HLA Major Medi and HLA MediShield plans. Please speak with your agent to find out more. Please note that any change of medical plan or an upgrade will be subject to full underwriting and a waiting period shall apply on the new plan.

Service Tax

Announcement

Please be informed that provision of all types of insurance policy to all business organization (B2B) is subject to 6% service tax effective 1 September 2018.

Hong Leong Assurance Berhad (“HLA”) reserves the right to collect from the policyholders an amount equivalent to the Service Tax payable on the applicable premium for the policy period. In the event that the policy period commences before but expires after 1st September 2018, HLA may collect from the policyholders an amount equivalent to the Service Tax payable on the applicable premium calculated from 1st September 2018 on a pro-rated basis.

The policyholder’s obligation to pay Service Tax shall form part of the Terms and Conditions in the policyholder’s insurance policy.

The laws governing Service Tax are as per the Service Tax Act 2018 and all Regulations passed by the Government of Malaysia from time to time.

For more information on Service Tax and the taxable insurance products, please refer to our FAQ.

Q1. What is Service Tax?

Q2. What is the rate of tax for Service Tax?

The Service Tax rate is 6% imposed on the value of taxable services or the actual premium paid for insurance policy. However, the Minister may, by order published in the Gazette vary or amend the rate of tax fixed under section 10(2)(b) of Service Tax Act 2018.

Q3. When is the effective date to impose Service Tax?

Service Tax will be imposed on taxable services made on or after 1st September 2018.

Q4. Who can charge and collect Service Tax?

Only service tax registrants can charge and collect the service tax.

Q5. Does Hong Leong Assurance Berhad (“HLA”) charge Service Tax?

HLA is a service tax registrant and hence, liable to charge service tax on taxable services.

Q6. How do I know whether a person is a legitimate entity to charge Service Tax?

A Service Tax registrant needs to issue valid invoices to charge Service Tax on the taxable services. The Service Tax registration number and Service Tax amount will be printed on the invoices.

Q7. What is the Service Tax impact on the life and medical insurance policy?

Provision of life and medical insurance policy to business organisation (B2B) will be subjected to Service Tax (i.e. where policy owner or assignee is a business organization). However, provision of insurance policy to educational institution and religious organisation registered under any written law are excluded from service tax. Provision of life and medical Insurance to individuals (B2C) are not subjected to Service Tax.

Q8. If I have paid for my group medical insurance policy in April 2018 for coverage period from 1 April 2018 to 31 March 2019, will I be charged with Service Tax for my premium from 1 September 2018 onwards?

If you have made full payment for the total premium including 6% GST, you will not be charged with Service Tax for the insurance coverage period from 1 September 2018 to 31 March 2019.

Q9. My group term life insurance policy is exempted from GST and has expired on 30 June 2018. I have renewed the policy and paid for the whole premium amount in July 2018 for the annual cover period starting from 1 July 2018. How will the service tax law impact my policy?

Q10. My group medical insurance policy is a GST standard rated supply and has expired on 30 June 2018. I have renewed the policy and paid for the whole premium amount with 0% GST in July 2018 for the annual cover period starting from 1 July 2018. How will the service tax law impact my policy?

Q11. Will businesses in Free Trade Zones be exempted from Service Tax?

Q12. Will there be an increase in insurance premium because of Service Tax?

Q13. Where can I get more information about Service Tax?

Q14. Do I need to inform HLA if I am granted an exemption from paying Service Tax?

Yes. HLA is a Service Tax registrant and will charge Service Tax on all taxable services provided to you unless you are able to provide us a letter from the relevant authorities stating that you are granted an exemption from paying Service Tax.

Q15. Who should I liaise with for queries in relation to Service Tax on HLA insurance products?

Do contact our Customer Service Hotline at 03-7650 1288 during office hour or email to customerservice@hla.hongleong.com.my for any queries in relation to Service Tax on HLA insurance products.